Enhance online bank account opening to reduce high drop-off rates by providing a seamless registration process

Overview

DBS is Singapore’s leading consumer bank, financing Singapore’s growth since 1968. Banks such as DBS want to adapt to digital transformation because it matters today more than ever.

Financial services are under pressure to live up to the high expectations of today to conduct online banking as consumers get more accustomed to frictionless digital banking. They are also encouraging small to medium businesses to embrace digital banking has provided a crucial lifeline to persevere through the early stages of economic recovery.

YEAR

2019

The Challenge

DBS launched a campaign for their online business account opening for SME owners to drive conversion, however, it was ineffective because there is a significant drop-off on the account opening. They are unsure of user feedback and pain points in using the form.

User Research

We conducted usability testing and user interview with SME towkays (both DBS / non-DBS customers) to understand their banking needs for businesses so as to propose feature enhancements for online account opening. The task was to sign up for an online business account.

This is what users had to say during the usability tests:

- “The form is very long and it is painful to fill it up”

- “How do I go back?”

- “Uhh…don’t know some fields are not applicable to me”

digital banking. They are also encouraging small to medium businesses to embrace digital banking has provided a crucial lifeline to persevere through the early stages of economic recovery.

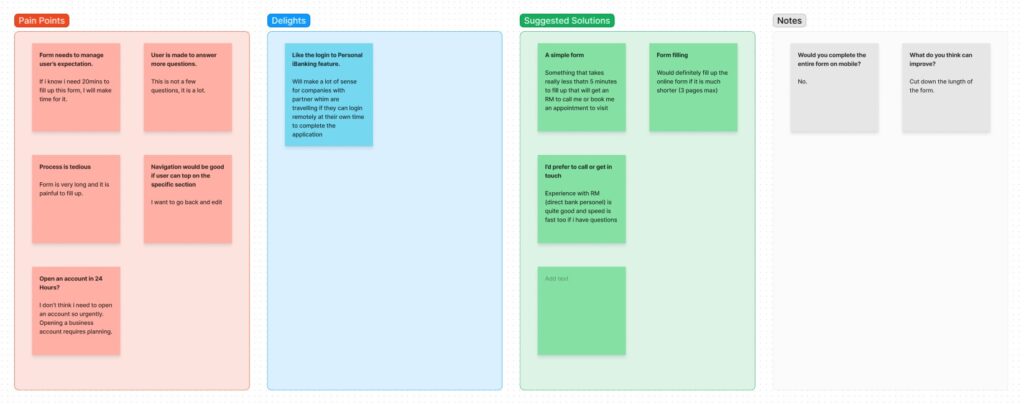

Analysis

We used Affinity mapping to group similar observations together. We used it to identify several key issues common among participants.

Problem Statement

How might we make it easier for busy business owners to sign up for an SME bank account so that they don’t feel intimidated or overwhelmed by the form-filling process?

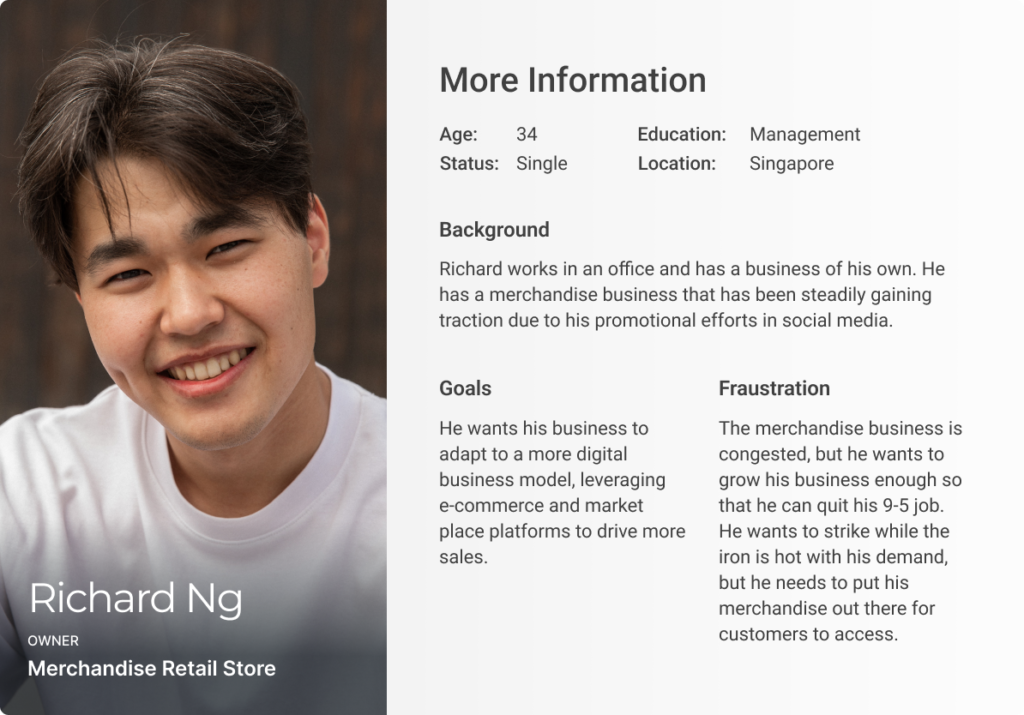

User Audience

Redesign

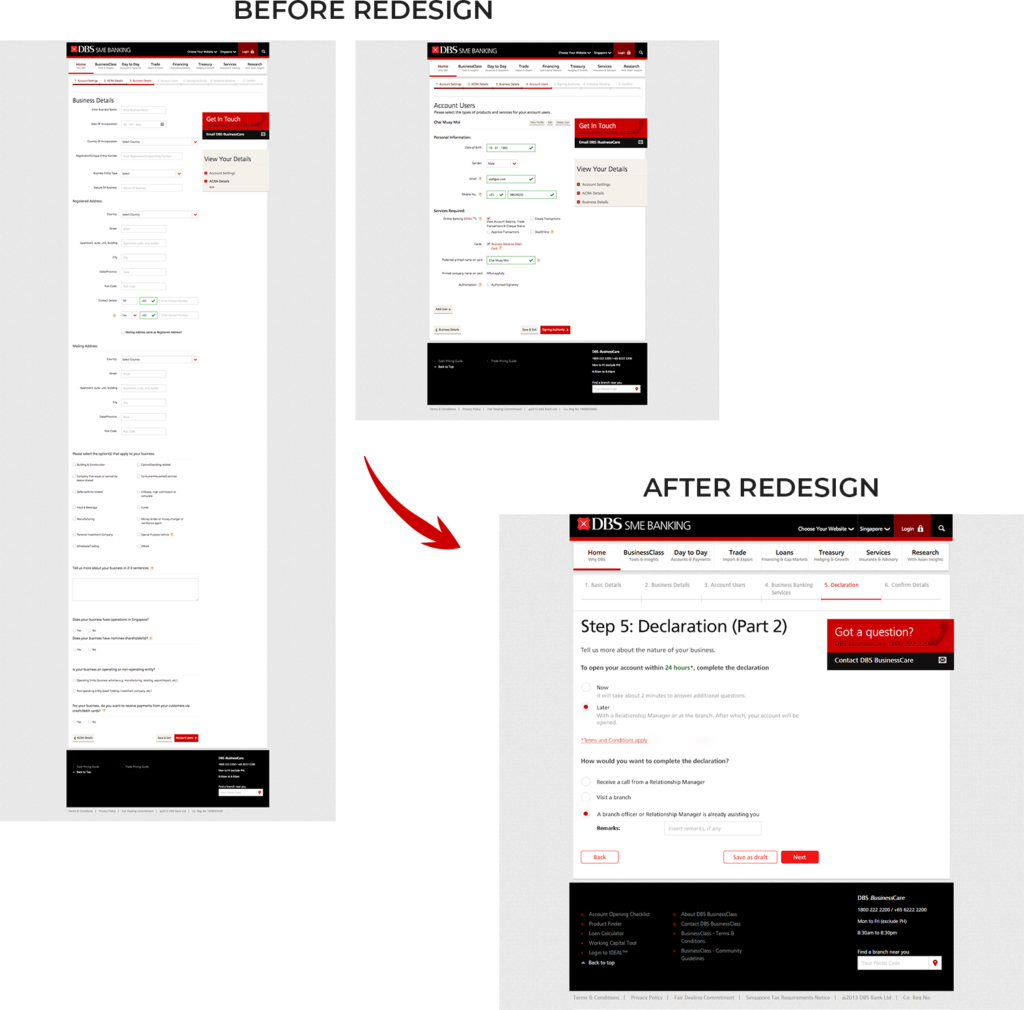

“The process is tedious. There are too many steps.”

Problem: Most users are complaining about the tedious process of signing up online.

Solution: We reviewed the online account opening form and optimized the steps without compromising the necessary information needed and reduced it from a 7-step process to a 6-step process by removing redundant or unnecessary fields.

“The copy lies. Was expecting to complete the form within 5 minutes, but filling this up definitely requires more than 5 minutes”

Problem: The previous form did not manage the user’s expectations. They felt like it was too much just to get an appointment for an RM to call or visit a bank.

Solution: The previous business account opening form flushed out all the fields including optional fields and not applicable fields depending on the business account type selected. We made use of radio buttons to apply an “if” and “else” to the fields that are mandatory to the application reducing the form-filling fields significantly.

We also optimized to process by reducing the text fields and using more radio buttons, dropdowns, and checkboxes so that it is more tolerable to fill up using their mobile device.

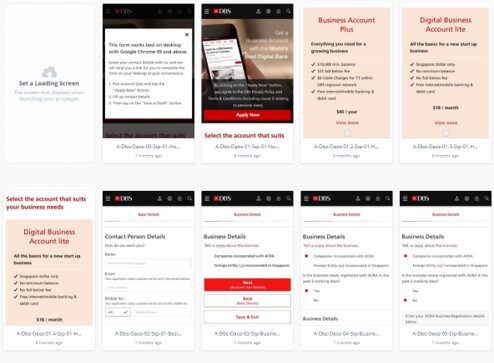

Prototype

Our solution was to re-prioritize form fields and introduce automation processes to reduce redundancy and increase conversion.

Outcome

Ultimately, the process of opening a bank account was streamlined and shortened. The customer journey map served as a roadmap for the redesign initiative. Early results showed a reduction in abandonment, users spending less time filling up the form, and an increase in online account openings after the launch.

Lessons

#1 Simplifying fields/data entry

As much as possible, the digital account opening process should minimize customer data entry requirements. Basic personal identity information should be captured and auto-filled wherever possible. It is also important to utilize radio buttons, checkboxes, and drop-downs to reduce the likelihood of abandonment due to the fact that customers hate to key in information in text fields.

#2 Mobile Responsiveness

Considering the statistic of device use in Singapore. majority of the customers who open accounts online will use a smartphone. We need to prioritize and optimize the mobile-first design to ensure the client’s customers get the same experience they would get on a PC / desktop.

#3 Prevent Application Abandonment

Abandoned sessions are often the result of ordinary, everyday interruptions. The ability to save and resume account openings at any point in the process and resume right where they left off without have to restart the process would be great.

#4 24/7 Support

It is important that customers have access to customer support throughout the entire application process. It may be a live agent or a chatbot.

View other case studies

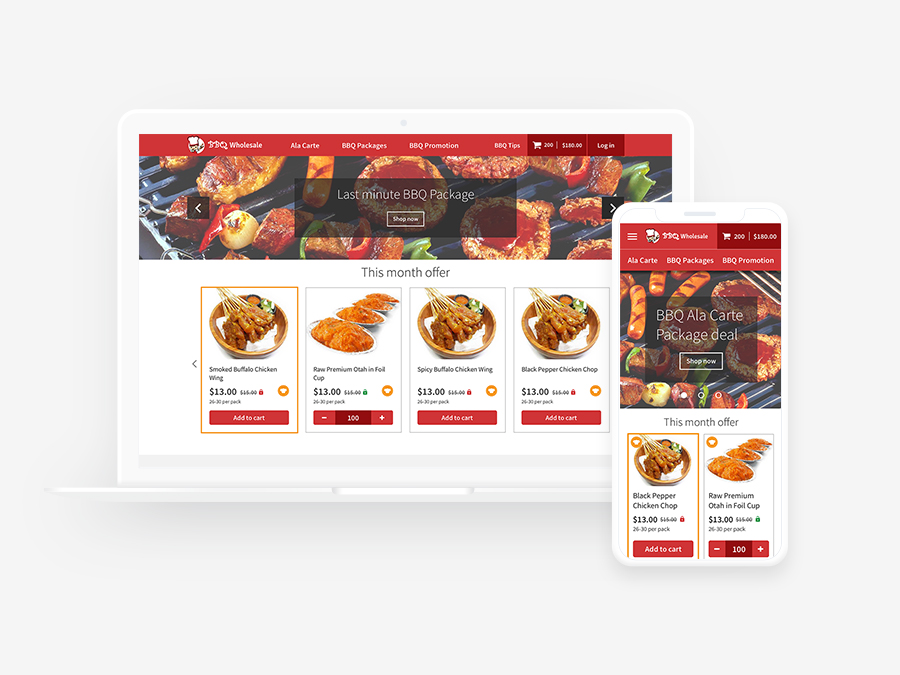

Case Study

Empower customers by providing a seamless shopping experience for complex purchases

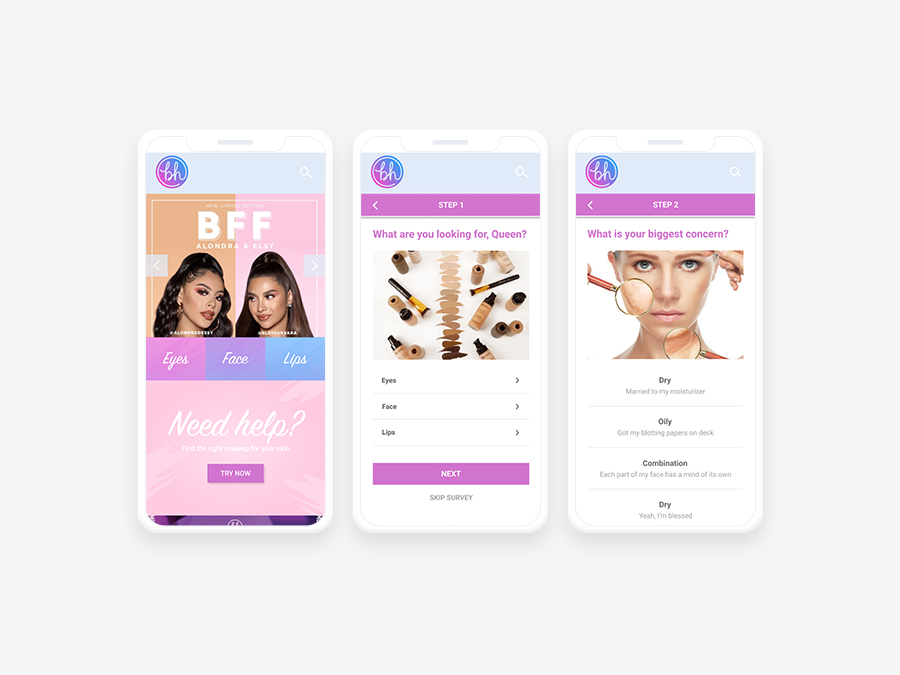

Case Study

Assisting beginners find the perfect makeup that compliments their skin